The Small Business administration (sBA)

Congress created in 1953 the Small Business Administration (SBA). As a federal government agency with the purpose to promote small businesses. Its function, as mentioned in its mission statement is to “aid, counsel, assist and shield the interests” of little businesses. Thus to preserve, to keep up and strengthen the economy.

The SBA has established standards for each non-public sector business within the United States. Being accomplished via the North American Industry Classification System (NAICS). As a result NAICS standards use the quantity of staff & average annual receipts to work out which businesses are thought of as small.

These standards are industry specific. For example a producing business cannot exceed five hundred employees to be considered small. Wholesale trade corporations cannot exceed one hundred employees. Equally important the annual receipts of retail trade cannot surpass $7 million. Finally, general and significant construction should be below receipts of $33.5 million.

Access to Capital

Today, the SBA has minimum one workplace in every state. Employs over 2,000 individuals and has an annual budget of $985 million. The agency provides services to more than one million entrepreneurs and little business house owners annually. In January 2012, President Obama elevated the SBA into his Cabinet.

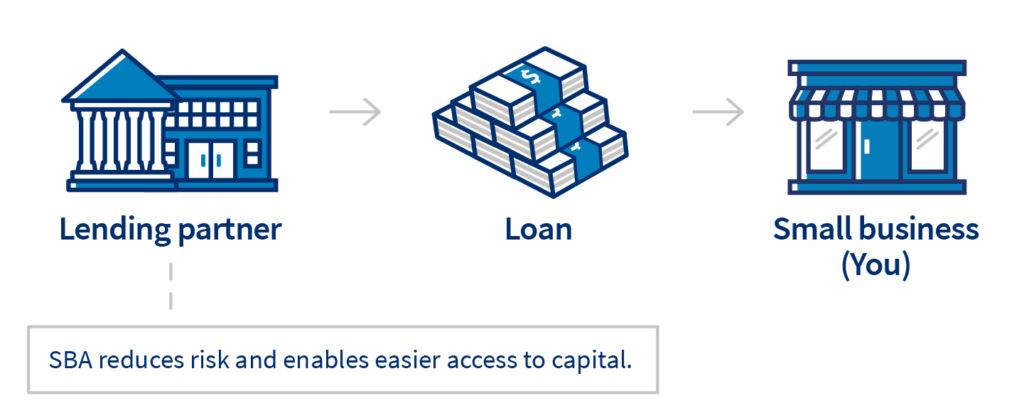

Generally, the SBA doesn’t give personal loan or direct loans. Strictly business loans to start ups. Thus it partners with financial institutions like banks, credit unions and alternative lenders. However there are two exceptions: Its Disaster Relief Loan Program and PRIME program.

The SBA provides help through its four main programmatic functions:

- Access to capital,

- Entrepreneurial development,

- Government catching

- Support

SBA’s Programs

Partly warranted by the federal government, is why the partners issue SBA loans. Partners being banks, credit unions and alternative lenders. They facilitate finance for little businesses that will be denied funding underneath typical disposition guidelines. Furthermore SBA loans and features of credit will help businesses begin or grow. Consequently helping them obtain assets or build, and/or buy existing businesses.

- Disaster Relief Loan Program: This program provides low interest rate loans to homeowners, renters, businesses of all sizes. Also to most non-public noncommercial organizations. With the need to exchange or repair property and assets that are broken by a natural disaster.

- PRIME Grant Program: The Program for Investment in Micro-Entrepreneurs (PRIME) provides grants to assist low-income entrepreneurs. Therefore permitting them to gain funding and grow their little businesses.

- 7(a) Loan Program: Assisting start-ups and small businesses to acquire financing is the programs purpose.The loan limit is $5 million.

More SBA Programs

- CDC/504 Loan Program: This could be a semi permanent funding tool. Being designed to encourage economic development among a community. It gives funding for the acquisition or construction of assets. Specifically the purchase of business instrumentality and machinery. Lenders provide 51% of financing. Likewise the CDC (Certified Development Company) created underneath the program provides 40%. Thus the entrepreneur has to put up the remaining 10%.

- MicroLoan Program: The program provides little, short-run loans to small businesses. Also to different kinds of noncommercial kid care centers. The max loan quantity is $50,000. The loan will be used as operating capital. In order to get inventory or supplies. Including articles of furniture or fixtures, and/or machinery and equipment.

- Military Reservist Economic Injury Disaster Loan Program (MREIDL): This program is meant to assist little businesses that lost essential staff. They lose them for what is referred to as up to active duty. In addition loan amount will be up to $2 million. Therefore the borrowing company has a loan term of thirty years max to repay in monthly payments.

Venture Capital

The SBA licenses and regulates Small Business Investment Companies. SBICs that are in private hands and managed investment funds. These corporations use their own capital. Thus the money borrowed has an SBA guarantee. To form equity and debt investments in qualifying little businesses. For instance as of today there are over three hundred SBICS.

Entrepreneurial Development

The SBA provides free coaching and counsel to entrepreneurs. Thus providing small business home owners counsel in over 1,800 locations throughout the United States.

Similarly it provides grants to control roughly 900 Small Business Development Centers. Also to a hundred and ten Women’s Business Centers. Including 350 SCORE chapters (a volunteer mentor corps of retired and experienced business leaders).

8(a) Business Development Program

SBA 8(a) program assists a specific group of people. Operated by people who are socially and economically disadvantaged. For examples girls and minorities.

hubzone program

An SBA program for small corporations that operate and use individuals in Historically Underutilized Business Zones (HUBZones). Hubzone certification is one of the most important SBA programs.

Government Contracting

The SBA’s Office of Government and Contracting works with alternative federal departments and agencies. To make sure that 23% of prime federal contracts are awarded to small businesses.

With five percent to women owned small businesses and little deprived businesses. Furthermore nothing less than 3% to service disabled veteran-owned small businesses and authorized HUBZone small businesses.

In 2011, over $90 billion of federal contracts went to small businesses. This workplace conjointly provides data for reaching to small businesses concerning acquisition opportunities.

Small Business Innovation Research Program (SBIR)

This program encourages small businesses to explore sophisticated innovation and vie with larger businesses. Thus by reserving a selected proportion of federal Research and Development (R&D) bucks for small businesses. Furthermore eleven federal agencies and departments are needed to order a little of their R&D funds for this program.

Small Business Technology Transfer Program (STTR)

Five federal departments and agencies reserve a little of their R&D funds for start ups. Especially small businesses that partner with a noncommercial analysis institution.

Conclusion

The SBA acts as the voice for little businesses. Therefore conducts a study on the start up environment on their regular business days. The Office of Advocacy testifies to Congress on behalf of small business. Assessing the impact of regulations.

Biz Central USA has wealthy insight into this agency. Thus all of the benefits for stakeholders.

In addition we can help determine whether your organization meets the requirements to become part of the SBA program. Please contact the offices of BizCentral USA to speak to one of our experts at (833) 217-9667 or info@bizcentralusa.com. We can help guide you and your organization in the right direction.